Very positive sales results for the pure electric cars in both USA and Europe. The latest data released by JATO Dynamics indicates that the growth in the demand of these cars is not only a matter of China, the world’s largest market for this kind of vehicle.

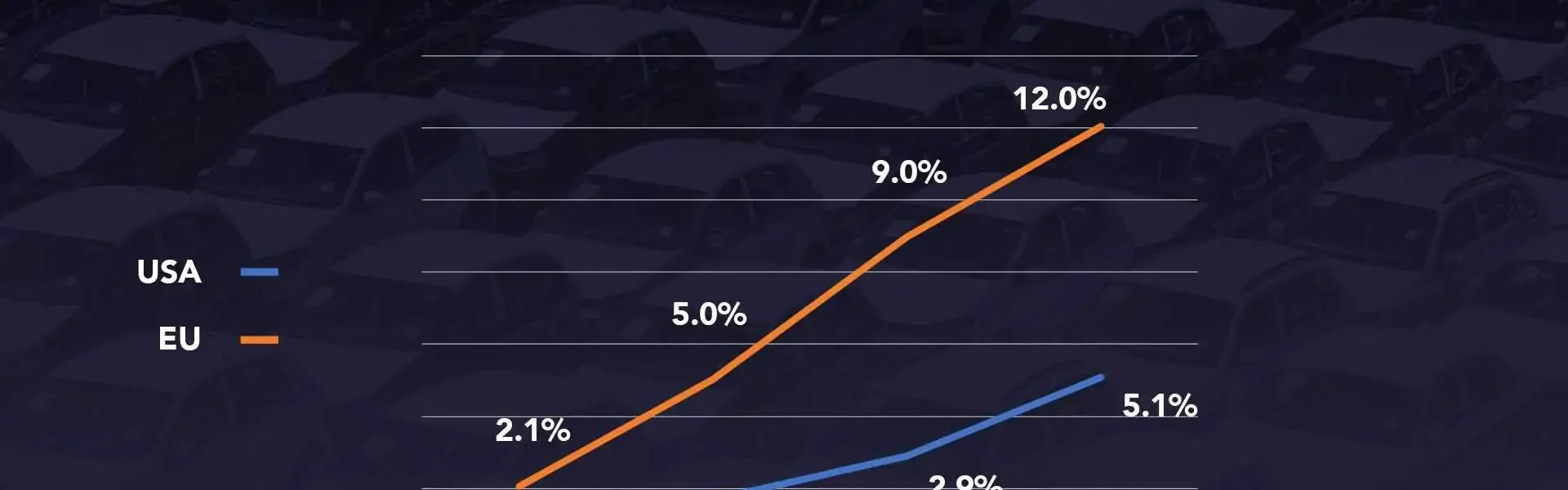

The market share for the BEV (Battery Electric Vehicles) in the USA totalled 5.1% between January and October 2022. Even if it is still small compared to the strong presence of combustion engines vehicles, it is remarkable to see the growth compared to the previous years. During the first 10 months of 2021, the BEVs made up 2.9% of the total market.

Two years earlier, in January-October 2020, they represented 1.7% of all new vehicle sales. Right before that in 2019, the BEVs counted for 1.3% of total market. The popularity of the Tesla Model Y along the good start of the electric trucks such as the GMC Hummer EV and Ford F-150 Lightning explain part of the rapid growth.

The trend is expected to continue in 2023 following the arrival of more affordable electric SUVs and trucks. It is important to mention that the consumers in USA buy mostly these vehicles.

More than 1 in 10 are electric in Europe

Despite the progress, the US electric car market lags behind Europe. JATO data for 23 markets in Europe shows that these vehicles made up 12% of the new passenger car registrations through October. This is equivalent to 1.09 million units out of the 9.09 million units for the whole market. The total climbs to 1.86 million if plug-in hybrids (PHEV) are added.

Therefore, the European total was 1.9 times higher than the American one. The gap has fallen considerably since 2020. That year, there were 2.5 electric vehicles registered in Europe for every electric vehicle sold in USA. Then the ratio fell to 2.4 between January and October 2021.

The European boom is explained by better infrastructure, more consumer choices, and good deals. In fact, sometimes it is easier to get a brand-new electric car than a petrol one. And this is because of the change in priorities that the OEMs are giving to their products.

As the semiconductor issue is here to stay, the very few available are being used in the most popular models (mainly SUVs), or in those that are easier to sell (EVs thanks to public incentives).

Next year these two markets are expected to see more significant numbers for EVs. The rapid adoption in certain markets is being driven by a more competitive offer. More affordable and interesting products are due to arrive next year.

The introduction of these vehicles includes big trucks and SUVs in the USA and small and compact SUVs in Europe. While the awareness among consumers increases and their willingness to drive electric is enhanced by better cars, it would not be strange to see a double-digit market share for BEVs in the USA, and more than 20% share in Europe.