The electric vehicle battery recycling market is expected to reach a value of $20.07 billion by 2028 from $8.2 billion in 2022, growing at a CAGR of 16.08% from 2022-2028The global electric vehicle battery recycling market is characterized by a low level of market concentration and intense competition among players. This competitive landscape compels vendors to continually adapt and enhance their unique value propositions to establish a strong presence in the industry.

The market is highly fragmented, with several key players holding notable positions. Some of the dominant vendors in the global electric vehicle battery recycling market include ACCUREC-Recycling GmbH, American Manganese Inc., Battery Solutions, and G & P Batteries Limited. These major players have a significant global footprint, operating in key regions such as North America, Asia-Pacific (APAC), and Europe.

As of 2022, North America emerged as the leading region in the global electric vehicle battery recycling market, with a market value of USD 1.65 billion. The region boasts numerous well-established industry players and a high degree of technological advancement. With continuous advancements in lithium-ion battery technology, the North American EV battery recycling sector is poised for robust growth, driven by a significant upsurge in demand for battery-related tools and accessories.

Consumer demand for innovative products and services is a key driver of growth in the electric vehicle battery recycling industry. Market participants are making substantial investments in research and development to meet this demand and stay competitive in the evolving market landscape.

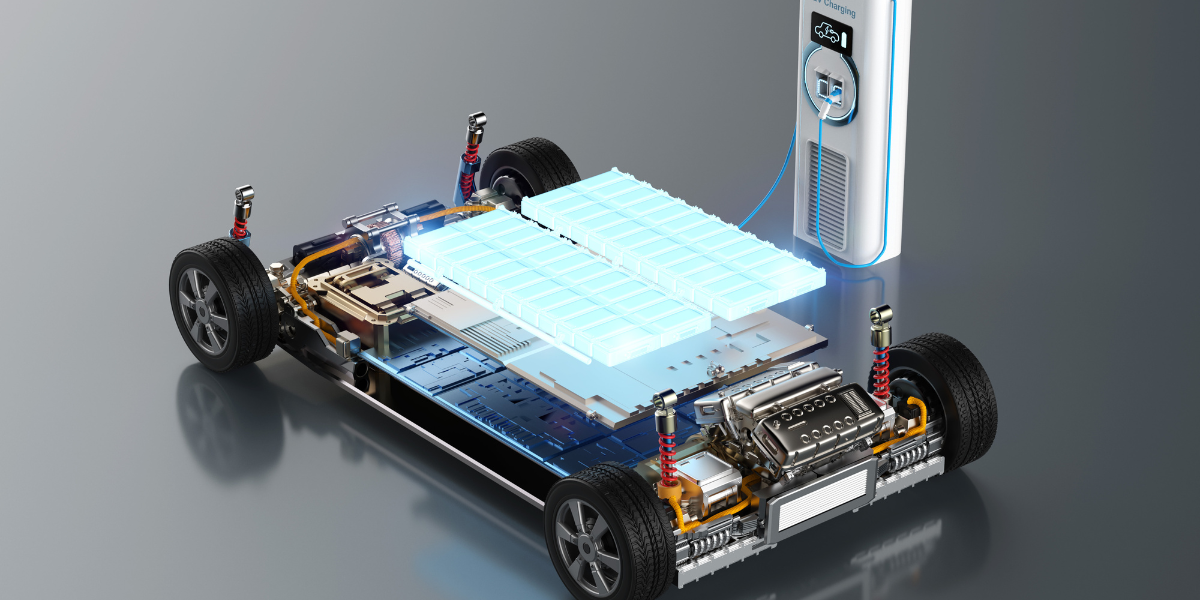

Exponential Growth of Battery TechnologySince 2000, batteries have undergone massive growth under technological innovations, resulting in lithium-ion battery development. Li-ion batteries are increasingly gaining prominence worldwide as rechargeable batteries. The expanding adoption of this battery is leading to the growth of its dominance year-over-year.

Due to the rising demand for enduring battery life, several advances were made in EV batteries for extra backup capacity. This has considerably improved the performance and efficiency of electric vehicle Li-ion batteries. It has also improved energy density, charging rate, cyclability, safety, and stability.

These batteries take less than an hour for a full charge and last longer. Hence, the demand for these electric vehicles (EV) batteries recycling market is growing significantly.

Rising Gasoline PricesGasoline prices are increasing continuously worldwide, resulting in a massive challenge for consumers and businesses. Most advanced countries have higher gasoline prices than developing economies as they major export gasoline vehicles and products. The price variation is due to diverse subsidies and taxes offered and charged by governments.

Hence, the constant increase in gasoline prices in various countries drives consumers toward electric vehicles, thereby supporting electric vehicle battery recycling market growth. The U.S., Germany, the U.K., and several other European countries are among the key markets for electric vehicles. However, rising gasoline prices in these countries promote electric vehicle adoption in the industry.

Instabilities in Raw Material Pricing

Raw material costs account for approximately 50%-60% of the overall cost of production in the global electric vehicle battery recycling market. The prices of major raw materials for producing and manufacturing electric vehicle batteries and their accessories – steel, plastic, and rubber – have been volatile over the last few years.

The instability of raw material prices poses a serious threat to vendor margins. Chinese manufacturers that offer cheap and high-quality EV batteries have added to the worries of prominent vendors to comply with the growing demand and changing industry standards cost-efficiently.

INSIGHTS BY PROCESS TYPE

The hydrometallurgical process segment accounted for the largest electric vehicle battery recycling market share in 2022.The large share of this segment is mainly attributed to the growing need to remove organic materials from Li-ion batteries and extract metals from ores with low metal content, increasing demand for a less expensive, scalable, flexible, low-cost, and low-environment-impacting recycling process.

The growing need to extract a wide range of materials, including copper, silver, nickel, lithium, and zinc, the increasing need for selective separation of materials through chemicals, rising demand for low energy consumption, less waste, and low impact on the atmosphere are responsible for the growing demand for hydrometallurgical process segment.

INSIGHTS BY CHEMISTRY TYPE

The global electric vehicle battery recycling market by chemistry type segments as lithium-ion batteries (Li-ion), lead-acid batteries, nickel, and other batteries.In 2022, the lithium-ion batteries segment is expected to account for the dominant segment in the global market. Lithium-ion batteries used in electric vehicles contain many valuable materials worth recovering, which are disassembled and shredded for recycling. Once shredded, the materials are sifted and categorized based on their nature and size.

INSIGHTS BY END USERS

The global electric vehicle battery recycling market by end-user segments into commercial vehicles and passenger cars. The commercial vehicles segment is anticipated to account for the largest global industry segment.

Factors such as the rising government subsidies & tax rebates for using low-emission commuting vehicles, increasing government initiatives for the promotion of e-mobility, increasing investments to develop advanced commercial EVs, limited lifespan of batteries, and charging infrastructure are contributing to the large industry share of this segment.