WEX (NYSE: WEX), the global commerce platform that simplifies the business of running a business, today announced that its Board of Directors has authorized a new investment arm of WEX, WEX Venture Capital, to invest up to $100 million through the end of 2025, which will likely be made predominantly in early-stage companies focused on the energy transition, including areas such as fleet electrification, the electric vehicle (EV) charging ecosystem, energy management and optimization, and adjacent technology. WEX Venture Capital has already started to deploy capital, including minority investments in Chargetrip and ev.energy.

“WEX Venture Capital is proof that we do not have to choose between doing what’s right for business and what’s right for the future of mobility,” said Melissa Smith, Chair, Chief Executive Officer, and President, WEX. “From routing and energy management to fuel payment systems, the energy transition will benefit from innovation in fleet management offerings, creating flexibility for our customers to seamlessly charge or fuel at work, home, and en route. WEX Venture Capital’s investments will be aimed at supporting companies focused on the critical back-end infrastructure necessary to achieve widespread commercial EV adoption, while also creating new value for WEX’s global fleet customers navigating the evolving electric mobility ecosystem. This is a crucial moment for WEX and the larger fleet industry, and we’re proud to help lead this transition.”

Already a trusted advisor to fleet mobility customers, including more than 18 million vehicles serviced globally as of Q2 2023, the portfolio companies in which WEX Venture Capital expects to invest will have the potential to benefit from the capital investment as well as the potential commercial opportunities presented by WEX’s fleet mobility customers and partners across the broader and evolving fueling and charging ecosystem.

“In the years to come, the energy transition will transform how we move employees and goods around the economy,” said Jay Dearborn, Chief Strategy Officer, WEX. “WEX Venture Capital positions WEX to not only serve our commercial customers with the innovation we drive from within, but to also participate and help unlock rich innovation that is happening across the ecosystem.”

The new initiative reflects the importance of engaging with outside innovators and companies, which complements WEX’s historical approach to growth through traditional M&A and internal development efforts. WEX Venture Capital diversifies WEX’s long-term strategy by positioning the company to identify new revenue models, provide visibility beyond WEX’s current product roadmap, and participate in the early-stage product innovation ecosystem as many of its fleet mobility customers begin to migrate from internal combustion engine vehicles to EVs and mixed fleets as part of the energy transition.

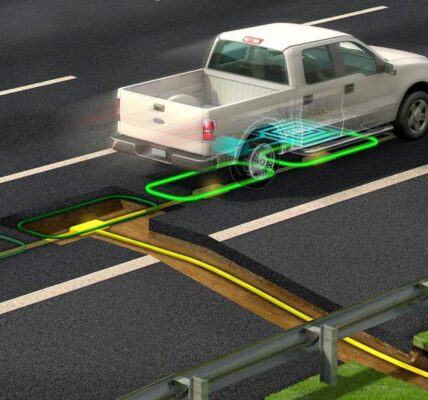

WEX Venture Capital’s investment thesis is reflected in its recent investments in Chargetrip, a Netherlands-based company focused on range prediction and EV routing for private drivers and commercial fleets, and ev.energy, a UK-based company offering a managed charging software platform for EVs. ev.energy announced its $33 million Series B round of financing today.

“We are thrilled to welcome Chargetrip and ev.energy to the WEX Venture Capital portfolio,” said Carlos Carriedo, Chief Operating Officer, International, WEX. “Chargetrip’s deep expertise in range prediction and routing technology for EV fleets and ev.energy’s managed charging platform are both critical in helping our clients optimize their EV investments. We look forward to collaborating with Chargetrip and ev.energy to help strengthen their first-mover advantage in market awareness, product maturity, and traction as fleets convert to EVs over time.”

“The investment from WEX Venture Capital is a major step towards our goal to be the number one design partner for electrifying fleets. With WEX’s network and fleet software expertise, Chargetrip will be able to access new customers, benefit from WEX leadership’s knowledge, and grow its North American presence,” said Gideon van Dijk, Chief Executive Officer and Co-Founder, Chargetrip.

“WEX Venture Capital is a great partner for ev.energy, giving us access to millions of fleet vehicles across the US and Europe. I’m excited about working with WEX to help fleet managers save thousands and reduce carbon emissions through the vehicle-grid integration of fleet EVs,” said Nick Woolley, Chief Executive Officer and Co-Founder, ev.energy.

WEX Venture Capital is launched as the growth of EV adoption reaches an inflection point. Given its leading position in the fuel payments industry, serving over 600,000 fleet customers worldwide, WEX Venture Capital enables WEX to play a meaningful role in the greater electric mobility ecosystem by assisting a variety of new stakeholders, from energy suppliers to charge point operators, OEMs, charging locations, and energy markets, among others as they streamline the future of charging and payments.